Identity verification is an often overlooked process that call center agents undertake on every interaction they have with customers. Agents typically ask for a couple pieces of information like birth date or social security number and then verify that the answers provided match what they have in their system.

For financial organizations such as banks and credit unions, customer identity verification is required to protect sensitive financial data and prevent fraud.

As customers, we also have an interest in protecting our finances and generally appreciate the security precautions taken as long as it doesn’t impact the customer experience too much.

Despite the importance and frequency of verifying people’s identity, the process in place at most organizations is informal and poorly tracked. In many banking cores, agents can see upwards of 10 different methods or questions that they can choose from and there is little data gathered from any invalid responses. In some organizations, this information is not in any system at all and is all done from memory.

It’s no surprise that when digging into which verification method agents choose, we find that they almost always choose the same one on every interaction, and it is the easiest one for customers to answer. Those questions also turn out to be the easiest for a fraudulent actor to learn the answer to—for example, birth date.

Building a more secure customer identity verification experience

To solve this problem for our clients we have built out a solution in Salesforce to guide agents through this process in a structured and time saving way.

First, we work with our clients to understand their ideal verification process from a security and customer experience standpoint. This includes refining the available methods and developing logic around which methods to use in certain situations.

For example, a best practice is to not ask the same question to a customer twice in a row. Fraudulent actors often will call in to learn which questions they might be asked and then they go and gather specific data before calling in a second time.

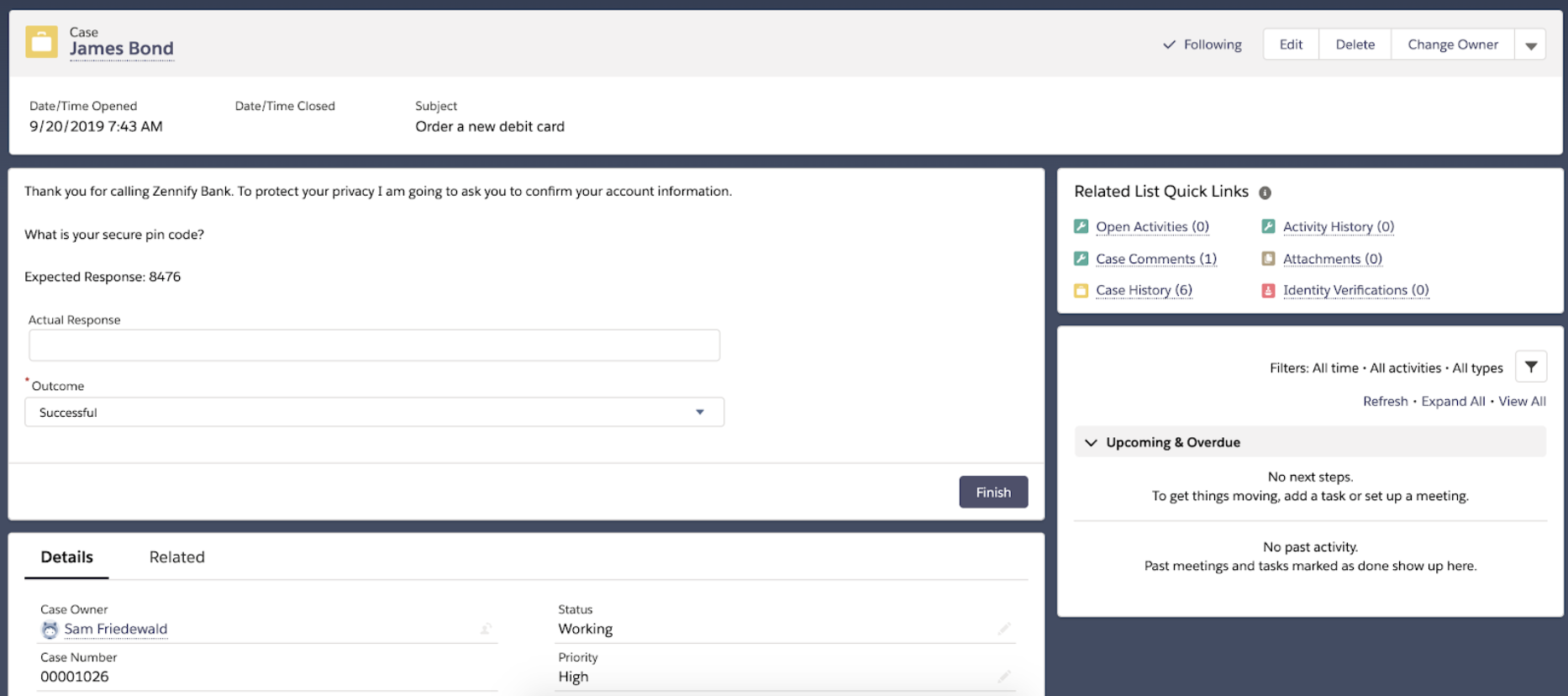

Once we understand the methods and logic, we create a user experience for the agents that guides them through the process.

We automatically present the question to ask and give them the ability to verify the correct answer was given and enter in the response when appropriate. The agent can then click next and proceed either to another verification method, if needed, or be directed to the next part of Salesforce they need for their type of call.

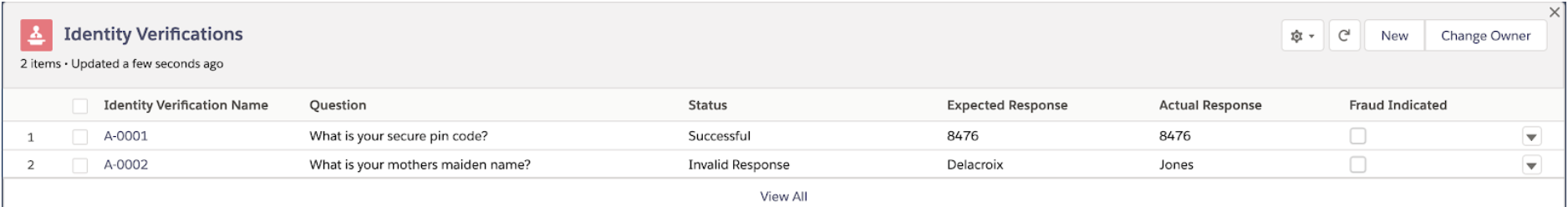

Once this process is done, we automatically create a record of the verification in the system and relate it to the case and customer records. This is important not only for compliance reasons, but also to improve the system with machine learning intelligence.

By keeping this historical data in the system, we will be able to improve the customer experience and also be able to spot fraudulent activity.

If someone calls in pretending to be a customer and can’t answer a certain question that has always been answered correctly in the past that might prompt a more thorough verification process. If the same phone number calls in repeatedly and claims to be different customers that number can be flagged as fraud.

On the other hand, if a real customer has a hard time remembering their first car every time they call in maybe that question isn’t a good way to verify their identity.

The guided experience of identity verification impacts the most important areas of running a service center in the financial services industry. It saves agents time, it provides a robust security and compliance model, and it improves the customers trust with you.