Important Dates for Spring ‘24

In 2024, financial institutions are grappling with a mix of challenges and focus areas, shaped by the evolving global economic landscape and regulatory environment. These key concerns include but are not limited to:

- Managing the integration of technologies like AI, digital transformation, and the shift to the cloud

- Understanding changing dynamics due to private equity and non-bank entities holding significant assets and influencing the market. Financial institutions need to adapt to these new competitive dynamics and reassess traditional business models

- Keeping up with evolving customer needs and concerns in trying economic times.

With so many features to look forward to in Salesforce’s Spring ‘24 release, here’s our take on the ones we believe can help your organization manage some of these focus areas.

Einstein Features that Enrich Your Salesforce Experience

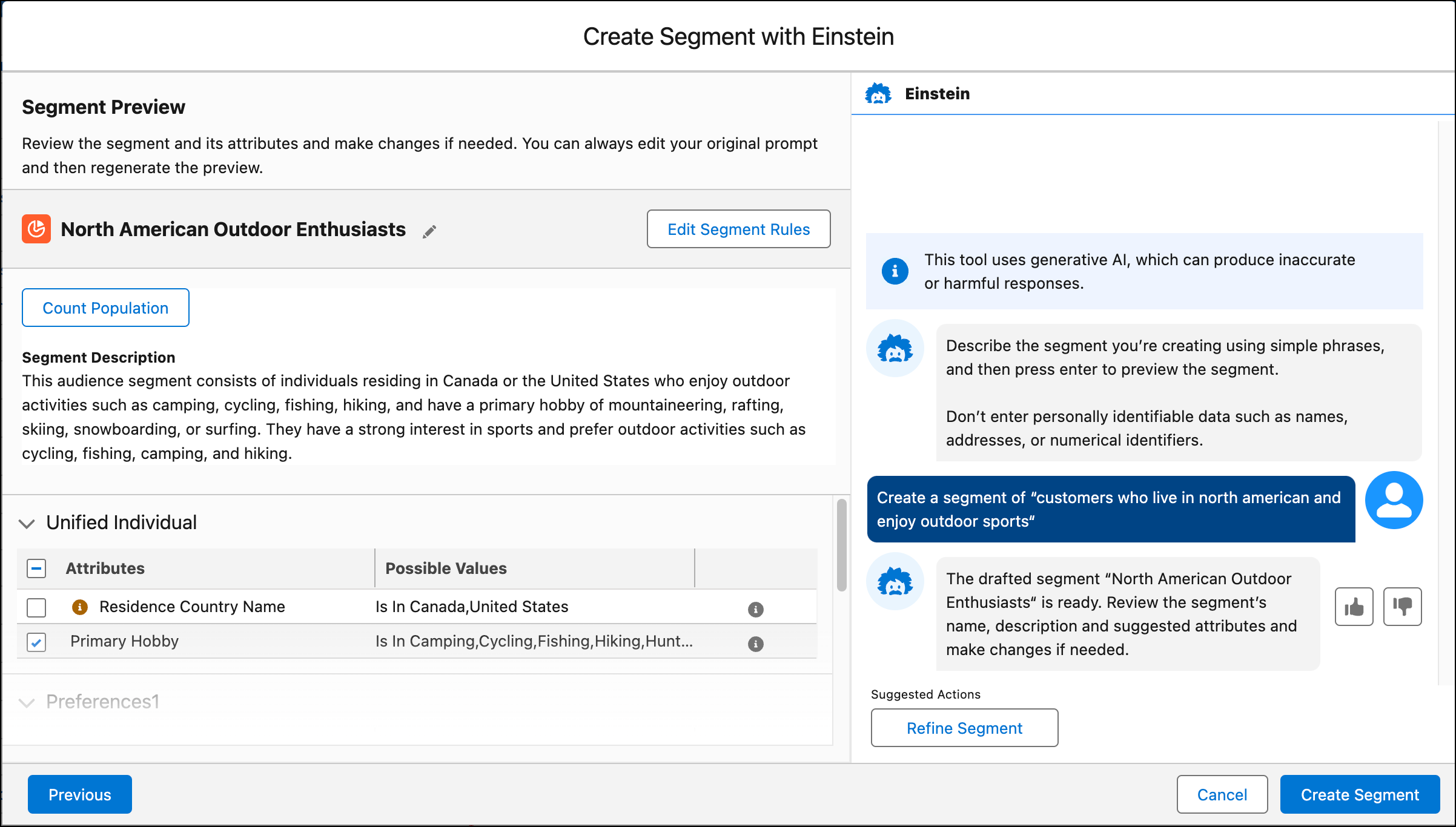

Einstein Segments in Data Cloud

Whether you’re a bank, credit union, or insurance company—how do you build a customer acquisition strategy for customers who expect a multitude of digital choices, and are constantly evolving? With the right digital marketing strategy, financial institutions can reach more people than ever before and specifically target the right potential customers.

Marketers in financial industries can use generative AI to build targeted audience segments in Data Cloud with Einstein Segment Creation. This is a powerful feature that takes action on Data Cloud data for marketing purposes. Just describe the target audience, and Einstein will generate the segment using customer data that’s available in Data Cloud. You can refine the segment as needed. Something we hear a lot from potential clients/marketers is that building engagement lists can be painful, so making this experience more “prompt-based” through AI seems like a win.

One thing to note: As with anything related to AI prompts, this feature is only as good as your data sources and data cloud strategy. To get the most out of this feature, make sure you define your data roadmap.

Contracts AI

Contracts AI uses generative AI to make it much faster and easier for sales, delivery, and legal teams to handle contracts, clauses, and documents. There are three capabilities to look forward to:

- Digitalize legacy contracts and create contract records: Financial institutions, like all organizations, may have long-standing client relationships over many years. Older contracts may need digitizing, and this feature enables that plus a proper digital document trail for financial advisors and back-office staff.

- Automate clause generation and quickly modify clauses: As clients’ needs mature or evolve, old contracts need to be updated to reflect both client and business adjustments. This feature enables the updates to be done quickly and efficiently while staying consistent in language and format.

- Instantly draft clause in Microsoft 365 Word add-in: This is a great feature, given that most financial institutions use the Microsoft Office suite daily. This feature accelerates the clause drafting process and enables users to create multiple clauses quickly instead of manually drafting them.

These features are a great way of consolidating your teams’ entire customer discovery and delivery experience, in Salesforce. It also seems like a healthy addition to some contract management in FSC. Salesforce has a more robust CLM presence in Revenue Cloud, and that would make sense to eventually offer in core FSC with more of a focus on authoring, redlining, and execution. From our perspective, we’d like to see more of this make its way into core FSC.

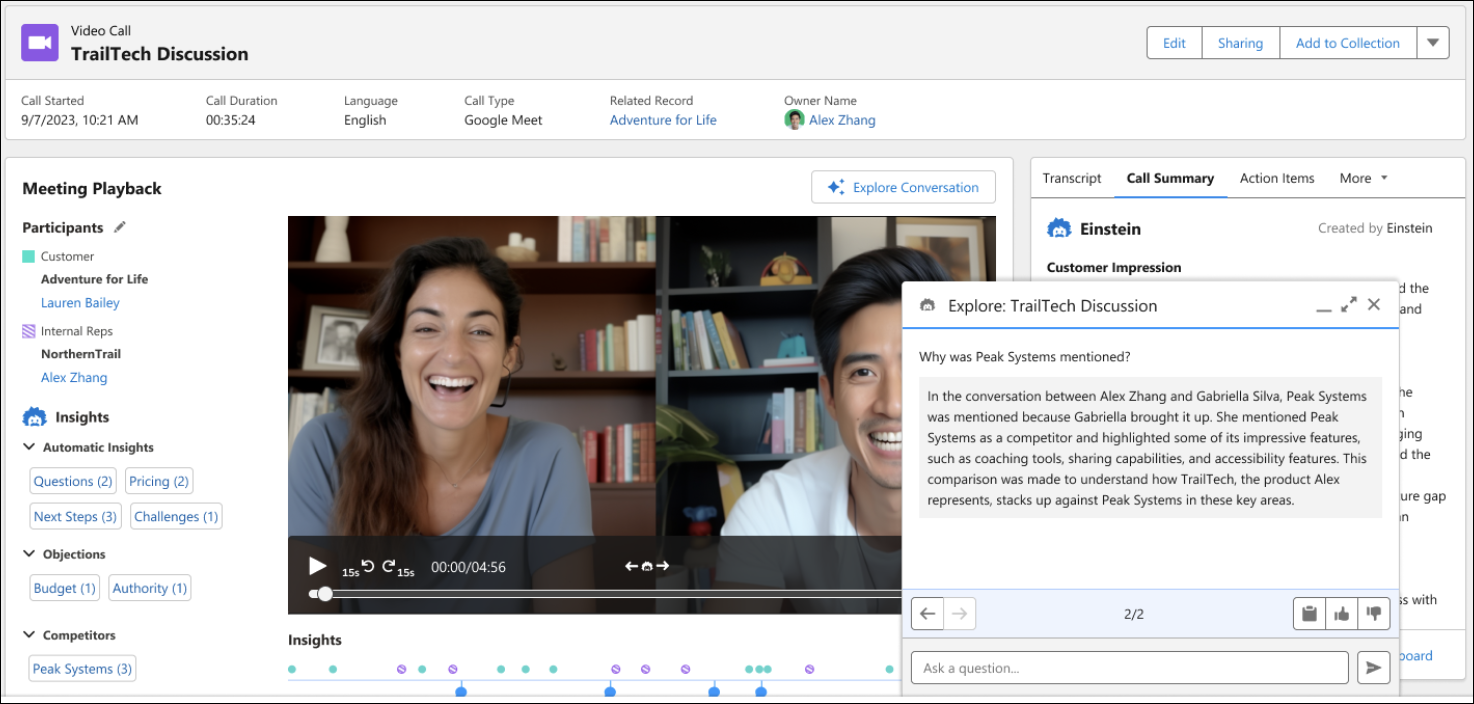

Ask Call Questions with Call Explorer, powered by Einstein

Call Explorer, powered by Einstein, offers a streamlined process for extracting crucial details from calls. This feature enables users to effortlessly identify specific elements such as references to products, potential risks in deals, or unresolved queries from customers. Here are some of the capabilities:

- Einstein Conversation Insights provides transcripts, insights, and action items for video meetings.

- Ask questions directly from voice and video call records to quickly gather information. In our opinion, we like that these questions are cached for later reference by that individual user. From a service perspective, Salesforce is very heavy on the ‘console’, which means users are tracking multiple instances of conversations/cases at one time. Therefore, storing these insights for reference is very useful.

- Einstein Conversation Insights users can now create and edit summaries for voice and video calls in languages other than English.

Enter questions related to the call, and Einstein provides an answer. The Call Explorer delivers one answer per query. You can toggle between different questions you’ve asked with the arrow buttons.

In our opinion, this seems like a more conversational feature, with Salesforce leaning into AI prompts and Q&A. This is a useful feature for anybody in the front office looking to track down more details around keywords or to have call details and context summarized.

Notable Mention: Get 10 Einstein Conversation Insights Licenses with Enterprise Edition. Orgs using Enterprise Edition can now get 10 Einstein Conversation Insights licenses.

Einstein Studio in Data Cloud

Privacy and customer information data are important considerations for financial institutions as they figure out how to build their AI strategy. We believe that Einstein Studio in Data Cloud is a good stepping stone for teams that are thinking about creating their own enterprise LLMs and ensuring a layer of security and privacy.

This brings in predictions from models in Databricks and connects to generative AI large language models (LLMs) from OpenAI and Azure Open AI. Financial institutions can now use their AI models in batch transforms, flow actions, and Prompt Builder. This saves time in the implementation (extract, transform, load) process since it’s being used in conjunction with Data Cloud.

Einstein Search

Work faster, complete tasks directly from the search results, and get results that are most relevant to you. Use Search Manager and Search Settings to configure search features and enhance results.

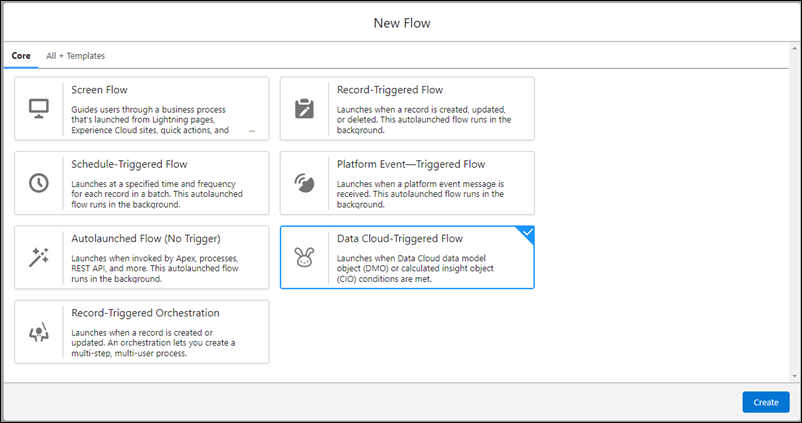

Top Flow Updates

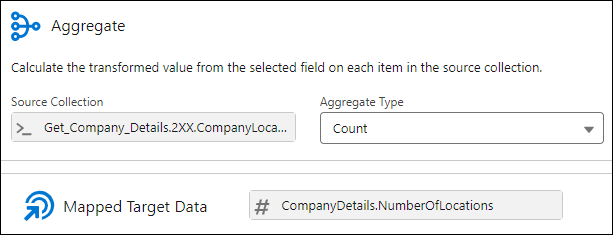

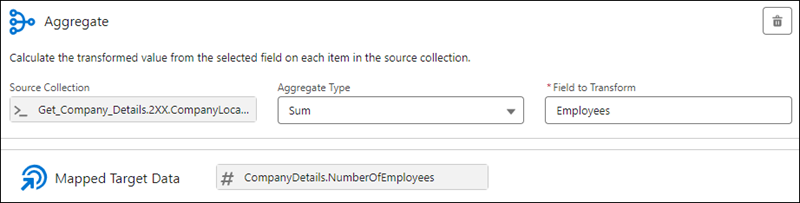

Transform Element Aggregation

We wrote about Winter ‘24’s Transform element in Flow update, which was a new way to transform collections of data. The Spring ‘24 release expands upon this – now, you can aggregate data from a source collection to calculate the sum or count of items in that collection and assign the result to a target data field. You can also enter a fixed value for a target data field.

This is a great expansion because it allows for more actionable functionality around bucketed pieces of data within Flow, which is always a good thing. We would love to see Salesforce continue to expand on this with data in Flow. Read more here.

Reactive Components for Salesforce Flow

This is a great visualization tool in Flow Builder, making flows more practical and user-friendly. This release enables reactivity within Text Templates in Flow. You’ll be able to see the email draft being built in real-time as you populate the fields.

AI Predictions in Flow

If you have Data Cloud, your Flow can now benefit from the AI models set up within Data Cloud, and call them throughout the Flow.

Create Multiple Instances of a Set of Fields with the New Repeater Component

How often do you have to input the same information across your screens? You can now populate all options on one page before moving on to the next. This is a great quality-of-life feature for screen flows.

Account Engagement (Pardot) Highlights

New Email Builder

Have you clicked Edit in Builder from your email content records in Account Engagement (Pardot)? Give it a try the next time you edit an email.

Generate Content with Einstein in Account Engagement

Safely use generative AI to streamline your content creation process. This is especially helpful when reaching out to high-value customers one-on-one, or if you’re building out a wider customer acquisition strategy for new deposits. Quickly create forms, landing pages, email subject lines, and email body copy with Einstein Assistant for Account Engagement.

Improved Personalization with Profile Reconciliation

You’ll soon be able to import email engagement data from Account Engagement to use in Data Cloud for profile reconciliation. This helps you build a more complete picture – a true Customer 360 – of your customers, via the Account Engagement connector.

Dashboards, Analytics, and Visualizations!

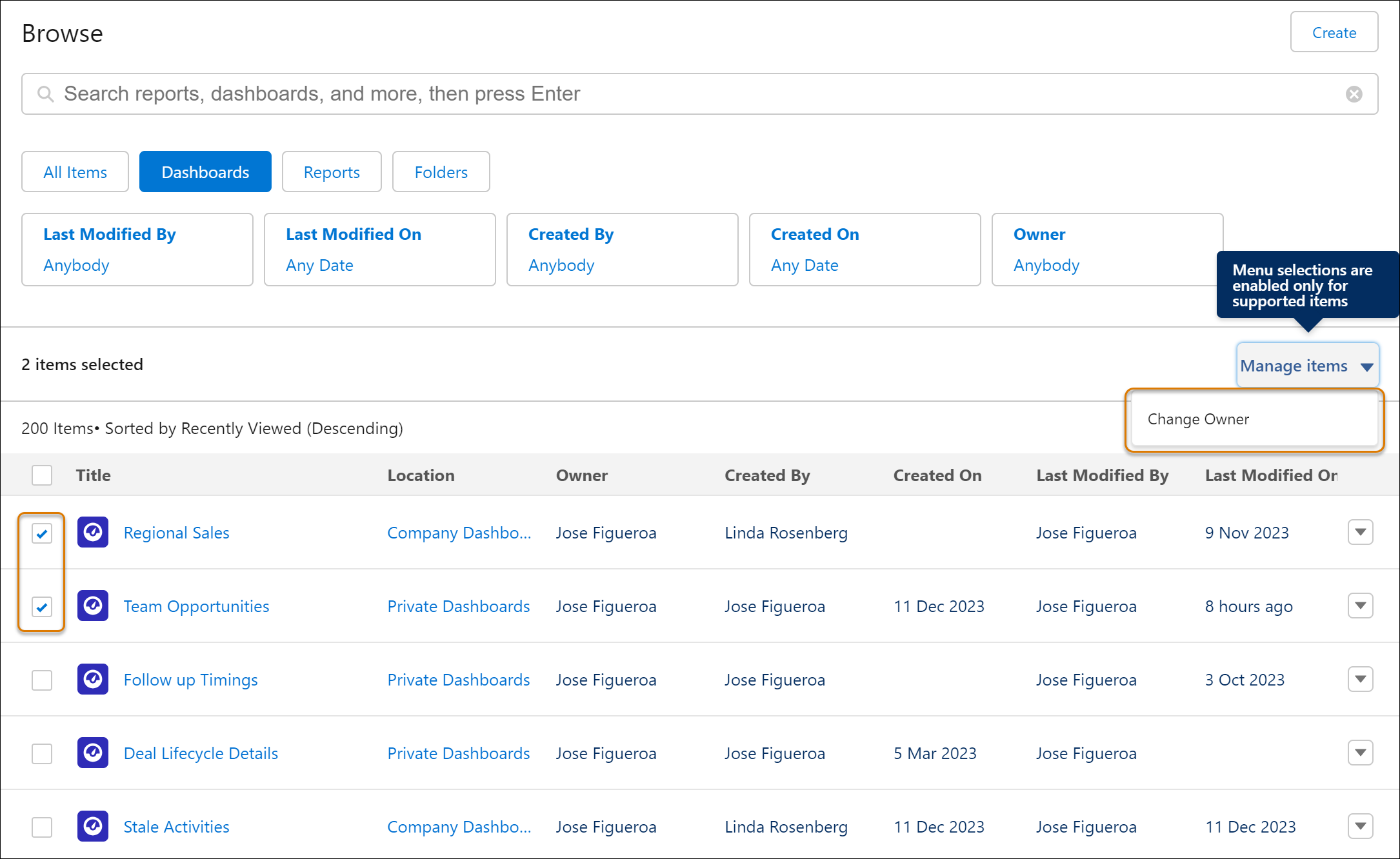

Transfer Lightning Dashboard Ownership

Many organizations have been waiting for this feature – some even for over a decade! Forget duplicating and recreating dashboards – just transfer ownership seamlessly. You can even transfer ownership of dashboards in bulk. This is a great admin tool for folks who no longer need or want to be owners of a particular dashboard, and/or have left the organization.

Admins can now quickly reassign them so that others can continue to view them. This is a great add for a scalable security model as well.

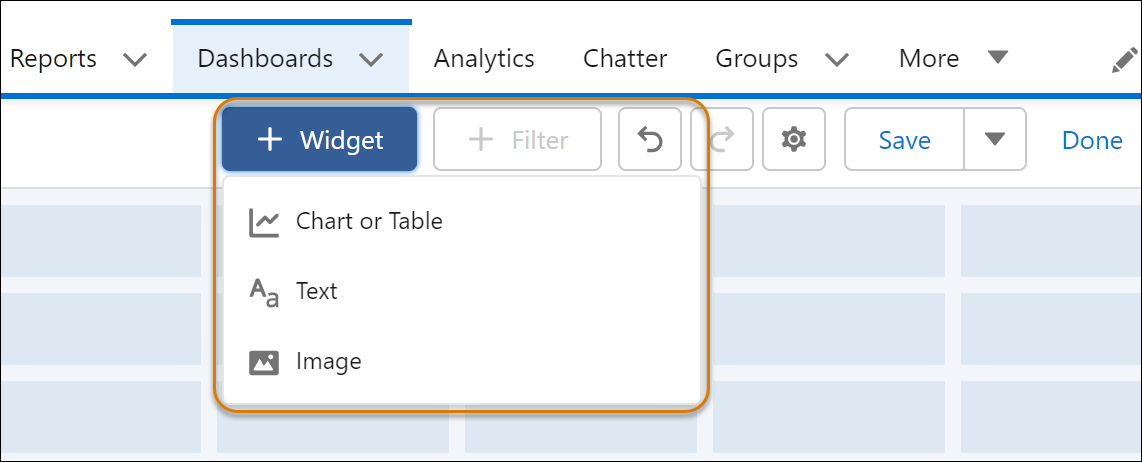

Rich Text, Images, and Dashboard Widgets to Supercharge Your Visualizations

Help your data tell a compelling story, with rich text, logos, branding, flow diagrams, and embedded images – even animated GIFs! Dashboards now support up to 25 widgets, including a maximum of 20 charts and tables, 2 images, and 25 rich text widgets. The former limit was 20 in total. Previously, this feature was available only in Unlimited Edition and Performance editions. This is now available for all editions.

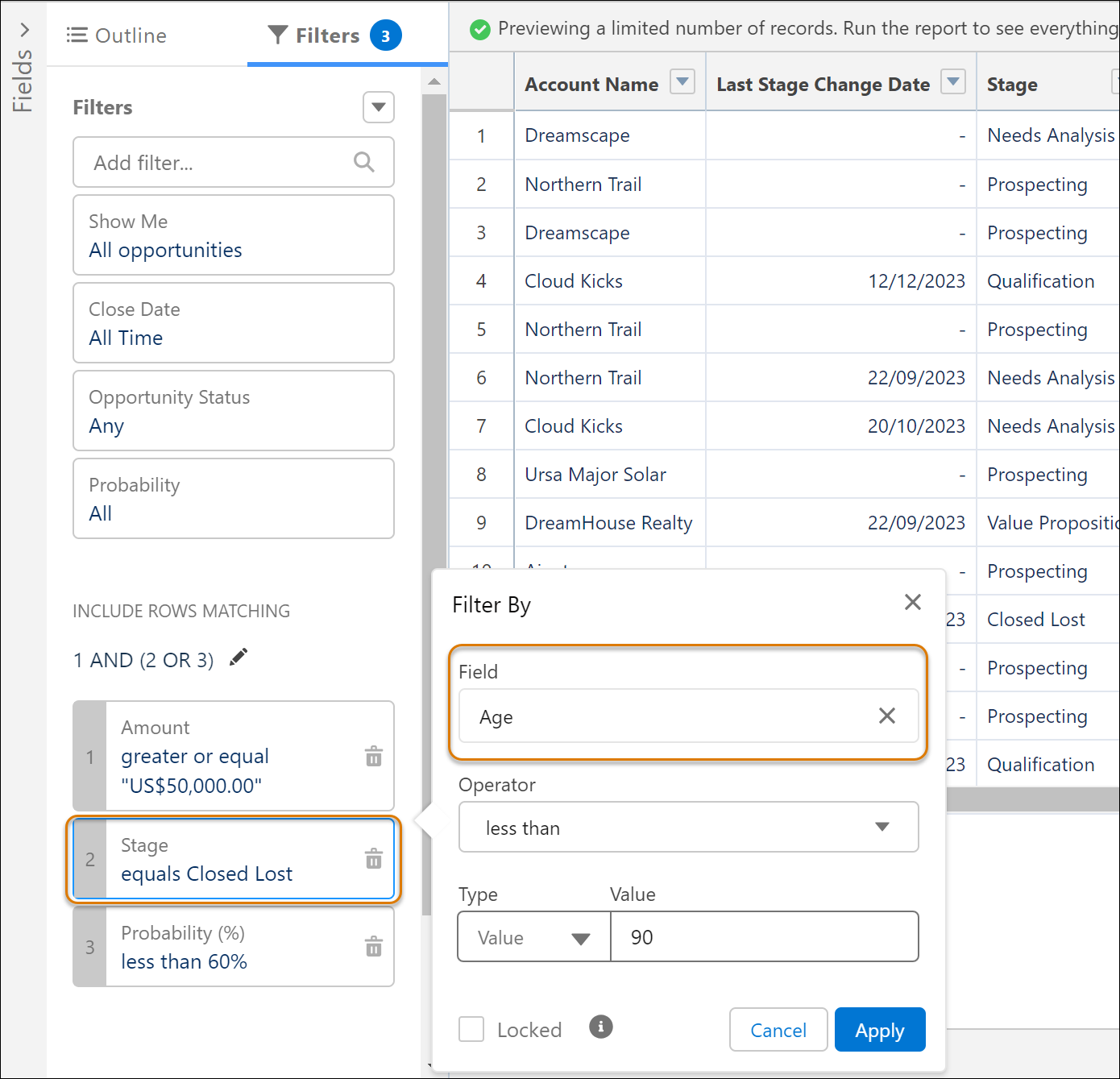

Easily Update Fields in Lightning Report Filters

This is another great quality-of-life feature, improving on a pain point many users had. Previously, you would have to delete the filter on your report and add a new one. Now, you can simply select the new field you want to filter, instead of having to delete the filter.

When Will I Benefit Fully From This Release?

Your Salesforce production instance will be upgraded to the new Spring ‘24 release on either of these dates:

- January 12, 2024

- February 2, 2024

- February 9, 2024

Remember to test all the main use cases in your org before these dates! If you would like additional information, check out the official full list of the Spring ‘24 Release notes here!

The financial industry sector will continue to face a myriad of evolving challenges – from integrating technologies like AI, adapting to marketing shifts caused by influential non-traditional financial entities, and continuing to meet evolving customer needs in a turbulent economy. Amidst this backdrop, the highlights from Salesforce’s Spring ‘24 release can help financial institutions navigate these complex dynamics and drive digital transformation.